GREAT EXPECTATIONS

Based on public statements prior to the Budget Address, and comments made by the IMF in their Article IV Consultation Report following their visit to Saint Lucia in January 2017, there was an expectation that the 2016-2017 Budget would contain bold new reforms to grow the economy and reduce unemployment.

This was not quite what it turned out to be.

In the Budget Address for the financial year 2017/2018, delivered by Prime Minster the Hon. Allen Michael Chastanet on May 9th, 2017, he stated that this budget was part of a four-year plan that will reform, transform and modernise Saint Lucia, providing the foundation for future growth and development of our economy.

He promised an institutional framework and transformation program that would require “bold, courageous and decisive leadership”, an “aggressive pro-growth strategy led by a competitive private sector” and strengthening the capacity of Government to accelerate the pace of implementation”.

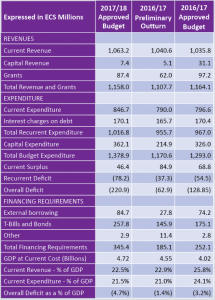

Our Budget commentaries are usually designed to inform our clients and the public as to the details of proposed new programs and reforms, especially those affecting income tax and other fiscal changes. This Budget can best be described as a foundation budget for a medium-term strategy, with specificity as to the intent, but not the content, of the reforms and other fiscal measures that will be implemented during the 2016/2017 financial year. The following Table shows the Budget Estimates for 2017/2018, the preliminary results for the Financial Year ended March 31, 2016 and the Approved Estimates for that year. It provides a snapshot of what was contained in the 2016/2017 Estimates, what transpired during the last year, and what is projected in the Estimates for the coming year. The Appropriation Bill for 2017/2018 has not yet been formally passed as of the date writing of this commentary.

ESTIMATES 2016-2017

The total Budget Expenditure of $1.378.9 million in 21017/18 does not include Public Debt principal repayment of $124.5 million ($122.2 million in 2016/17). The budgeted expenditure is $86.0 million (6.6%) higher than the Approved Estimates for 2016/17 but $208.3 million (17.8%) higher than the preliminary results for that financial year. The biggest increases over the preliminary figures for 2016/17 are in Capital Expenditure (68.5%) and current expenditure (7.2%), and the overall deficit is budgeted to increase to $229.9 million or 4.7% of GDP.

The total Budget Expenditure of $1.378.9 million in 21017/18 does not include Public Debt principal repayment of $124.5 million ($122.2 million in 2016/17). The budgeted expenditure is $86.0 million (6.6%) higher than the Approved Estimates for 2016/17 but $208.3 million (17.8%) higher than the preliminary results for that financial year. The biggest increases over the preliminary figures for 2016/17 are in Capital Expenditure (68.5%) and current expenditure (7.2%), and the overall deficit is budgeted to increase to $229.9 million or 4.7% of GDP.

ECONOMIC PERFORMANCE IN 2016

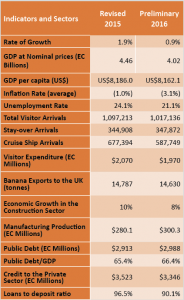

Some of the leading Economic Indicators for 2016 are provided in the Table below, along with a comparison of the revised figures for 2015. It was another tough year for Saint Lucia in almost all the leading sectors, and our economy continues to be characterised by low growth, high unemployment, and high debt.

The global economy now shows signs of improvement. In April, 2017 the IMF raised its world growth projections to 3.5% in 2017 and 3.6% in 2018, compared to 3.1% in 2016. With the notable exception of Trinidad and Tobago, most Caribbean countries appear to be growing. The economies of the OECS averaged a growth rate of 2.2% with some countries trending above average.

The challenge for Saint Lucia is how we break out of our economic stagnation to increase growth, reduce public debt and fiscal deficits, create new jobs and productivity, improve competitiveness and lower the high costs of doing business. The Budget speaks to many of these issues which have plagued most Caribbean countries over the last 10 years.

The Budget Address promised a new vision for Saint Lucia based on a roadmap for growth and development. It sets out strategic areas of focus to be aggressively pursued over the next four years with the underlying aim of achieving sustainable and inclusive growth. These included:

• Creating sustainable employment

• Reengineering Social Services

• Reforming Government to make it more responsive to the business community and citizens

• Improving Security and Justice

• Building Capacity in Renewable Energy

• Adapting to Climate Change

Few would take issue with the long-term objectives outlined in the Budget, but some may raise issues with the short-term priorities, the nature of some of the investments to be implemented or encouraged, and the risks of aggressively ramping up capital expenditure and debt to achieve economic growth and transformation.

Some of the strategies and proposals that are worthy of specific mention include:

• A National Apprenticeship Programme through partnerships with local and foreign private sector investors to provide new jobs.

• An Agriculture led strategy to create the environment to enable the private sector to participate in the development of the agriculture sector, and improve linkages with the Tourism sector.

• Advancing the Health Reform Agenda through public private partnerships for the provision of services and the introduction of national health insurance

• Resolving Insolvency through the enactment of new Insolvency legislation, and the establishment of a Credit Bureau, a Registry of Movable Assets and A Secured Transactions System.

• A comprehensive Road Infrastructure Programme for the restoration and rehabilitation of our road network to be executed over 5 years.

• The Castries Redevelopment Programme to address traffic congestion, sewerage and facilitate expansion of cruise and water related activities in the Castries Harbour.

Fiscal strategies included a

• VAT deferral system to minimise the impact of VAT obligations faced by local manufacturers; • Personal income tax reform;

• A Foreign Residency Program to attract real estate investment; • The creation of a Sovereign Wealth Fund;

• New Fiscal Concessions for regional and international companies to establish their Headquarters in Saint Lucia.

The VAT deferral system has been welcomed by manufacturers, and the necessary amendments to the VAT Act are due to be announced shortly. The IBC Act has already been amended in April 2017 (IBC Act (Amendment) No. 3 of 2017) to allow regional and international companies to take advantage of these incentives, and some applications have already been made by companies wishing to establish headquarters in Saint Lucia.

The only new Revenue measure announced in the Budget is the increased Excise Tax on Fuel, from $2.50 to $4.00 a gallon, which went into effect on June 1, 2017. The increase in revenue is designed to go towards maintaining and upgrading the road network and associated infrastructure such as bridges. The impact will be felt by all drivers, and may become an issue if the international price of oil increases, resulting in higher gas prices locally under the Modified Pass Through Mechanism for setting prices at the pump. This new tax is expected to yield about $25 million per year. It will be interesting to find out if drivers buy gas “by the amount” or whether taxi and bus drivers will seek increases in their regulated fares.

Other revenue measures previously announced for the 2017/18 year include an increase in the departure tax from US$25 to $63 effective June 2017, and a further increase to US$98 effective January 1, 2018. The rates for trips to other CARICOM countries and the French Overseas territories will increase from US$25 to $35.

The proposed personal tax reforms are somewhat similar with reforms included in the Budget address of 2016, but never enacted due to fears of tax revenue erosion. Under the proposals discussed broadly in the Budget, both the personal allowance and the applicable deductions would be reformed with a view to simplifying the system while simultaneously making it more progressive. It is also the intention of the Government to place a cap on personal income tax. Details of these reforms will be announced prior to their implementation.

There were many new Expenditure Measures announced that are designed to reduce Public Debt by reducing or eliminating transfers to specified Boards and Agencies of Government. This could result in the winding up of the Saint Lucia Marketing Board and the Saint Lucia Fish Marketing Corporation and Radio Saint Lucia, as well as reductions in the subsidies on bulk rice, flour and sugar provided through the operations of the Supply Warehouse.

Other measures include the reduction in the annual subvention to the Saint Lucia National Trust and proposals to privatise the Saint Lucia Postal Service. In most instances, the expenditure savings were not quantified, but the justification given was the reduction in current expenditure and public debt.

RISKS AND UNCERTAINTIES

There are risks and uncertainties with all Government Budgets, and it is becoming increasingly difficult to make economic projections due to the volatility and unpredictability of markets and geopolitical developments. The best laid plans of men and mice oft go awry.

There are many systemic as well as specific risks associated with the 2017/2018 Budget which could delay or hinder the completion of some of the planned programs and strategies. These include:

The increase in public debt. The policy of aggressively increasing public debt to finance capital expenditure to grow the economy, without compensating tax increases, could increase the public debt to unsustainable levels. The projected increase in financing, less principal repayment of existing debt, would increase Public Debt to $3.2 billion or 68% of projected GDP. With higher interest rates on new borrowings, this would place an unsustainable future burden for the servicing of Public Debt.

The implementation deficit. It is generally accepted that Saint Lucia has a problem with the timeliness and completion of capital expenditure. The completion percentage was 66% in 2016/17 and has been traditionally low in prior years. This has been due to capacity constraints in the applicable Ministries, the inability to obtain financing for capital expenditure, issues with the quality of certain projects and inefficient implementation.

The Prime Minister alluded to this “implementation deficit” in his address, but promised reforms that would facilitate the efficient execution of programs. It is unlikely that any such reforms would have an immediate impact, casting doubt of Governments ability to undertake capital expenditure of $362.1 million in the 2017/18 financial year. The inability to undertake planned capital expenditure will have an adverse impact on growth and employment.

The timeliness of new private sector investments. Many of the new private sector investments detailed in the Budget are real, and have been formally announced by the investors, but the ability to start or progress most of the projects during 2017/18 is dependent on many factors outside of the control of Government. These include the availability of CIP funds to finance part of the projects, the availability of bank loans from external sources, and delays in obtaining approvals and securing demand for real estate sales and tourism services critical to the success of these investments.

Some of the investments are already in progress (The HarborClub), or have recently broken ground (Sandals, Desert Star), and others expect to do so later this year (Sabwisha, Coconut Bay) but the extent of progress or completion on others is less certain.

The inability to obtain financing. Governments in the region are finding it increasingly difficult to obtain financing, from Grants, external borrowings or the sale of Treasury Bills and Bonds, to finance their capital or current expenditure. The 2016/17 Estimates projected financing of $252.1 million, but only obtained $185.1 million (73.4%). No bonds have been issued or sold to date in 2017, and most of the Treasury Bills issued have been used to roll over existing debt or finance current expenditure.

The interest rates requested by institutional investors are increasing, even though there is excess liquidity in the region, and it appears unlikely that Government will be able to raise $257.7 million in Treasury Bills and Bonds during the 2017/18 year from traditional markets. While the level of Grants projected in the Budget is based on known or approved sources, the ability to obtain new financing for planned capital expenditure will depend on financing from friendly Governments or non-traditional sources.

Public resistance to planned investments. There has been local public concern with two private investments supported by Government, which could have an impact on the willingness of these or other external investors to undertake projects in Saint Lucia. The concerns are in regard to the potential for abuse of the environment and cultural heritage, the sustainability of planned projects, an overdependence on the tourism industry and political differences on certain of the Budget strategies. These issues will need to be managed and mitigated to avoid reputational risks for the country, and ensure broader public support for the plans and objectives.

CONCLUSION

The Revenue projected in the Budget appears both conservative and achievable, notwithstanding the reduction in the general rate of VAT from 15% to 12.5% in February 2017. No announcements were made in the Budget regarding other changes to the VAT Regime, such as a reduction in the list of VAT-exempt items or the application of VAT on other supplies.

The fiscal policy of increasing the level of growth while improving the productivity of expenditure and reducing public debt is the appropriate strategy to address Saint Lucia’s current economic problems, but there is insufficient specificity on many of the measures that would allow us to quantify, with any degree of certainty, the likely impact on revenue or expenditure, or the feasibility and suitability of the measures contained in the Budget. Further comments will be forthcoming when the proposed changes and new initiatives are announced in greater detail.

We live in challenging times, and like many other countries, we need bold, courageous and decisive leadership to transform and modernise our economy and society so that we can achieve the economic growth and improvement in living standards to which we all aspire. To ensure success, growth must be inclusive and sustainable, and the strategies and programmes adopted will require further articulation, justification and public dialogue.

Grant Thornton St Lucia and St. Vincent and the Grenadines, together with Grant Thornton Antigua St. Kitts and Nevis, covers all eight countries of the ECCU. Both firms are member firms of Grant Thornton International Limited, a global organisation of member firms with 42,000 people in over 130 countries.

For further information on our Budget commentary and services, please contact the author, Richard Peterkin, at [email protected].